Table of Contents

ToggleHow to Budget Groceries

- Find your baseline: Track exactly what you spent in the last 30 days before changing anything.

- The Benchmark: Single people typically spend 8-12% of income; families spend 12-18%.

- The Strategy: Use store brands, shop once a week with a list, and avoid “shopping hungry” to reduce impulse buys.

If your grocery bill feels higher every month even when you’re “trying” you’re not imagining it. Small, frequent spending makes groceries one of the hardest expenses to control.

Groceries don’t come once a month. They show up every few days. Prices change. Small purchases add up quietly.

Many people try to “just spend less” on groceries. That usually doesn’t work. Not because they’re careless but because no one explains how to budget groceries in a way that fits real life.

This guide is written for beginners who feel overwhelmed by money rules and tired of failing at budgets. We’ll keep this calm and practical. And if something doesn’t work perfectly, that’s okay.

Why Grocery Spending Feels So Hard to Control

Grocery spending is confusing because:

- You buy food often, not monthly

- Prices change week to week

- Small items don’t feel expensive individually

- Food is emotional, not just practical

Also, most people were never taught:

- What counts as a “normal” grocery budget

- How to set limits without feeling restricted

- How to recover after overspending

This isn’t a discipline problem.

It’s a clarity problem.

How Much Should You Budget for Groceries? (Simple Benchmarks)

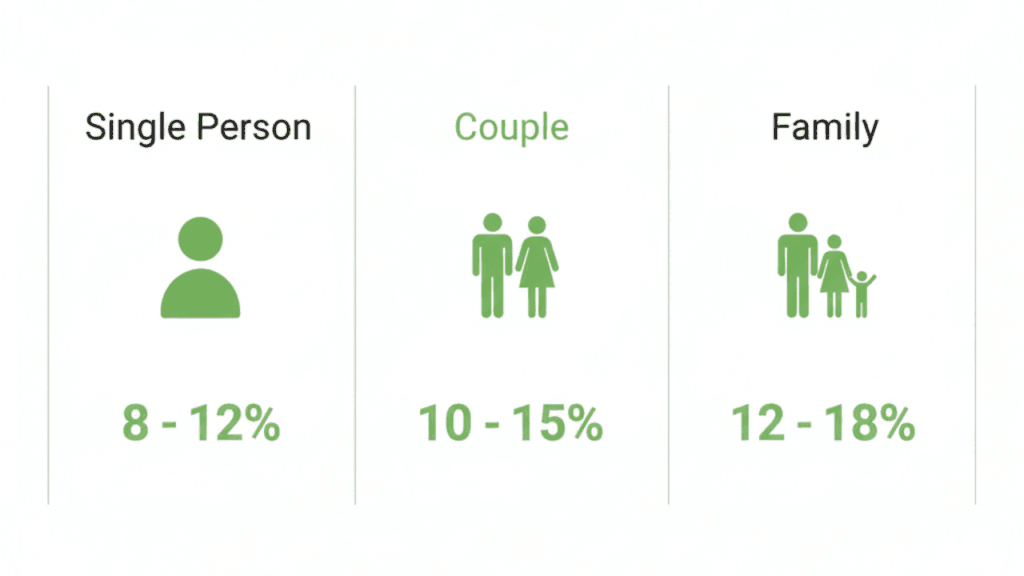

There is no perfect number, but benchmarks help you stop guessing. Here is the general rule of thumb for budgeting:

The Grocery Rule of Thumb:

• Single person: 8–12% of monthly income

• Couple: 10–15% of combined income

• Family: 12–18% of combined income

If you are slightly above or below these percentages, that is perfectly okay. Consistency matters more than comparison.

Average Monthly Grocery Budgets

These examples use local currency, but the structure works everywhere.

| Household | Monthly Grocery Budget |

|---|---|

🧍 Single Person | ₹3,000 – ₹6,000 (or local equivalent) |

👫 Couple | ₹6,000 – ₹10,000 |

👨👩👧👦 Family of 3–4 | ₹9,000 – ₹15,000 |

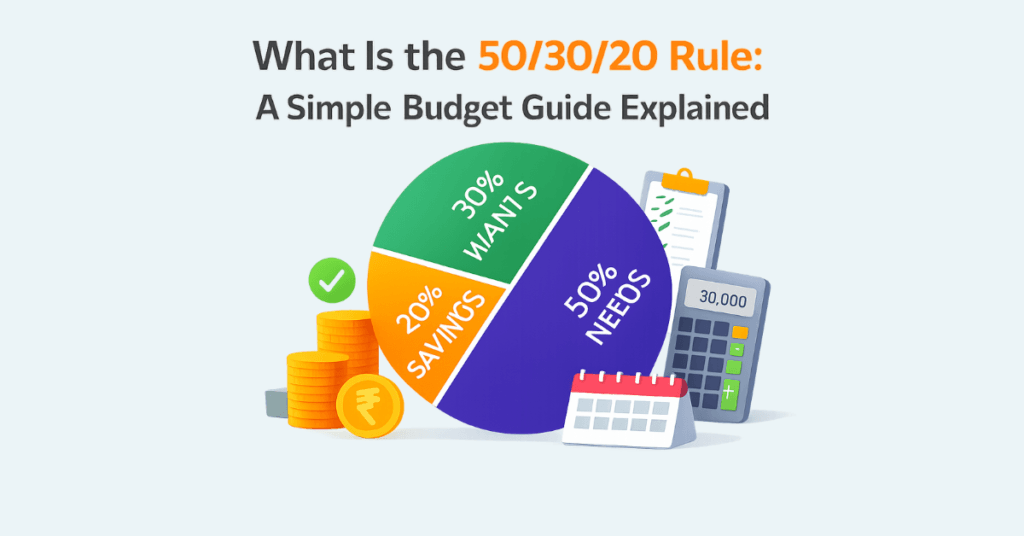

If you want context on how this fits your overall money, this guide on the 50/30/20 rule explains exactly how to split “Needs” and “Wants.”

Step 1 – Find Your Current Grocery Spending Baseline

Before changing anything, you need one thing: awareness. Do this:

- Look at the last30 days.

- Add up Supermarket bills + Local store purchases + Online orders.

Do not judge the number. Write it down. This is your baseline. You can’t improve what you don’t see.

Step 2 – Set a Grocery Budget That Fits Your Life

The goal is not to spend the least. The goal is to spend an amount you can repeat every month. Choose a method:

- Small Reduction: Take your baseline (e.g., ₹6,000) and try ₹5,500.

- Percentage Based: Aim for 10-12% of income.

Step 3 – How to Grocery Shop on a Budget (Without Feeling Deprived)

Budgeting groceries doesn’t mean eating badly.

It means shopping with intention.

Plan Before You Shop

This saves more money than discounts.

Try this:

- Decide meals for 3–4 days

- Check what you already have

- Write a short list

That’s enough.

You don’t need a perfect plan.

Smart Grocery Shopping Habits That Actually Save Money

These habits work quietly:

- Buying store brands

- Checking price per unit

- Shopping once or twice a week

- Buying staples in larger packs

- Avoiding rushed shopping

Small habits beat extreme rules.

What to Avoid When Shopping on a Budget

These usually break budgets:

- Shopping hungry

- Going without a list

- Buying “just in case” items

- Trying to eat too “perfectly”

Simple food that fits your budget is better than ideal food you can’t sustain.

💰 The Real Cost of "Small" Habits

Think spending ₹40 a day on snacks doesn't matter? Look at the math:

Total Wasted = ₹35,000 / Year

(Enough for a new Laptop or a Trip)

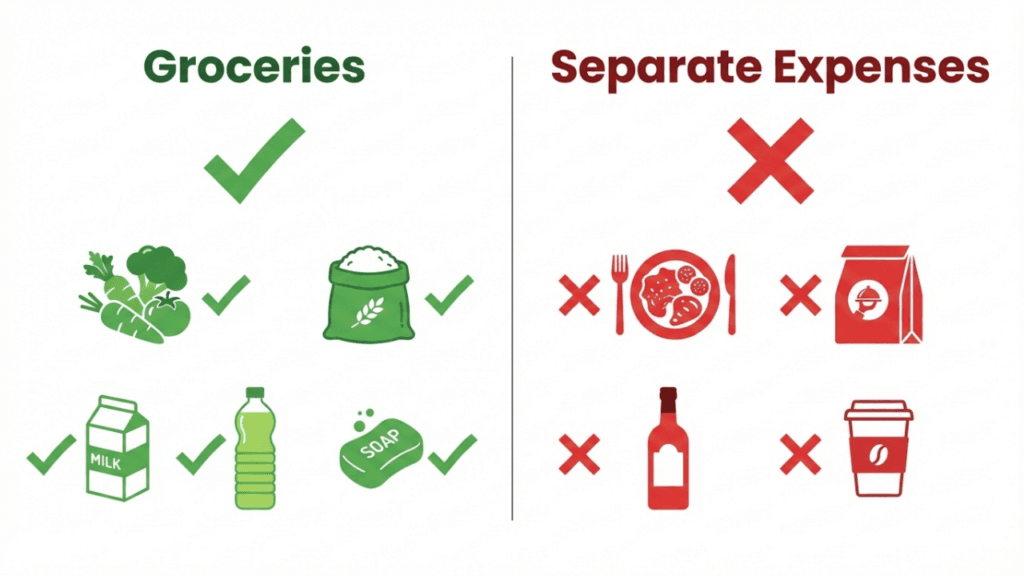

What Counts as Grocery Spending?

- Vegetables & Fruits

- Rice, Wheat, Grains, Milk

- Cooking Oil & Spices

- Toiletries (Soap, Toothpaste)

- Basic household snacks

Separate Expenses

Separate Expenses- Restaurants & Fast Food

- Food Delivery (Zomato/Swiggy)

- Office / Cafe Coffee

- Party & Event Food

- Alcohol & Cigarettes

If you mix these together, your grocery budget will always look too high.

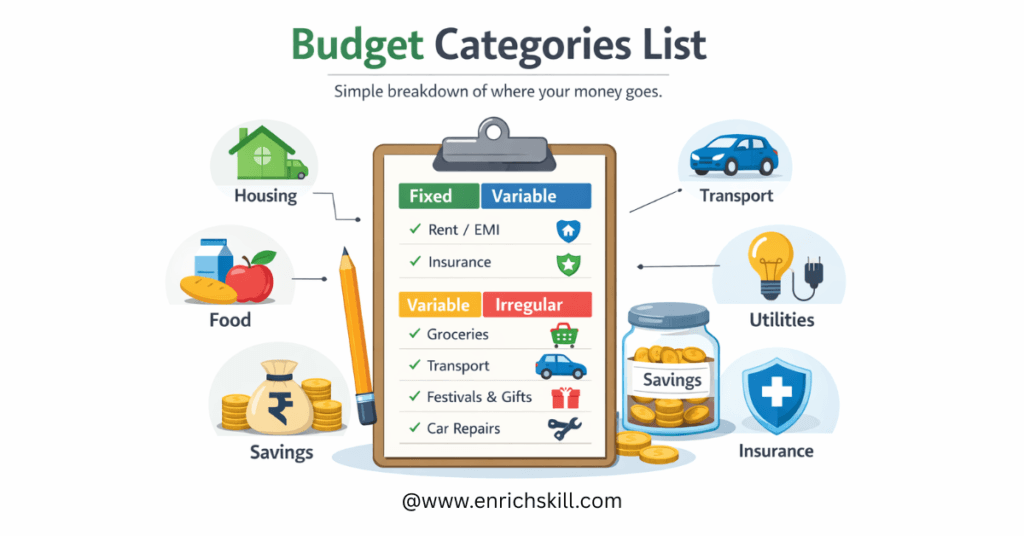

If you want a broader view of where groceries sit compared to other expenses, this budget categories list can help you separate things clearly.

Real-Life Grocery Budget Examples

- Monthly income: ₹30,000

- Grocery budget: ₹3,500

- Weekly target: ~₹850

Shops twice a week.

Keeps meals simple.

- Combined income: ₹60,000

- Grocery budget: ₹7,500

They:

- Plan meals together

- Shop once weekly

- Split responsibilities

- Combined income: ₹90,000

- Grocery budget: ₹12,000

They focus on:

- Staples in bulk

- Fewer impulse buys

- Repeat meals

None of these are perfect.

They are workable.

Common Grocery Budgeting Mistakes to Avoid

These are common — and fixable.

- Expecting spending to drop instantly

- Comparing with others online

- Cutting too much too fast

- Treating one bad week as failure

A budget is a tool, not a scorecard.

Simple Tools That Make Grocery Budgeting Easier

You don’t need many tools.

But one simple system helps.

Options:

- A monthly grocery spreadsheet

- A basic expense tracker

- A weekly spending check

If visuals help you stay consistent, a simple grocery budget template can help.

If not, that’s fine.

Tools are optional.

Awareness is not.

Final Thoughts: Grocery Budgeting Is a Skill

Grocery budgeting isn’t about discipline; it’s about awareness.

If this guide made things feel clearer, that’s progress. And if you still feel unsure, that’s okay too.

We build this slowly first budgeting, then saving, then earning, then investing one skill at a time.

If you want something simple to start with, a basic grocery tracker might help. If not, just start with one number. Either way, you’re moving forward.

FAQ's

1. How much should I budget for groceries each month?

A simple rule of thumb is:

Single person: 8–12% of monthly income

Couple: 10–15% of combined income

Family: 12–18% of combined income

For example, if you earn ₹40,000 per month, your grocery budget may fall between ₹3,200–₹4,800.

These are benchmarks — your actual number depends on city, diet, and how often you cook at home.

2. What is the average monthly grocery bill in India?

The average monthly grocery bill in India varies by household size:

Single person: ₹2,500–₹5,000

Couple: ₹6,000–₹9,000

Family of 4: ₹9,000–₹15,000

Metro cities may be on the higher end due to food inflation and higher living costs.

3. How can I reduce my grocery expenses without cutting quality?

To reduce grocery expenses without eating poorly:

Plan meals weekly

Shop once a week with a list

Buy staples (rice, wheat, dal) in bulk

Avoid shopping when hungry

Separate groceries from restaurant spending

Small system changes reduce costs more effectively than strict restriction.

4. What counts as groceries in a budget?

Groceries typically include:

Fruits and vegetables

Rice, wheat, grains

Milk and basic dairy

Cooking oil and spices

Basic household essentials (soap, toothpaste)

Restaurants, food delivery (Zomato/Swiggy), alcohol, and party food should be tracked separately. Mixing them makes your grocery budget look inflated.

5. Why does my grocery bill feel high even when I try to save?

Grocery spending feels high because:

You shop multiple times per month

Small purchases add up quickly

Prices fluctuate weekly

Impulse buys go unnoticed

Tracking your last 30 days of grocery spending creates clarity. Awareness reduces overspending more than “trying harder.”

ABOUT THE AUTHOR

MD JALEEL

Jaleel is the founder of EnrichSkill, an India-based finance and self-growth blog focused on simplifying money concepts for beginners. He is a self-taught finance learner, gaining knowledge through online courses, continuous research, and practical understanding of personal finance topics.

Disclaimer: Not a Certified Financial Advisor. Content is for educational purposes only.