If budgeting has ever made you feel tense or confused, you’re not alone.

Many people try budgeting once.

They download an app, open a spreadsheet, track everything for a few weeks…and then quietly stop.

That usually doesn’t happen because people are careless with money.

It happens because the system feels heavy.

The question what is the 50/30/20 rule often comes up at this exact point — when you want something simple, not another complicated method.

The 50/30/20 rule is popular because it removes pressure.

It doesn’t ask you to track every rupee or remember finance terms.

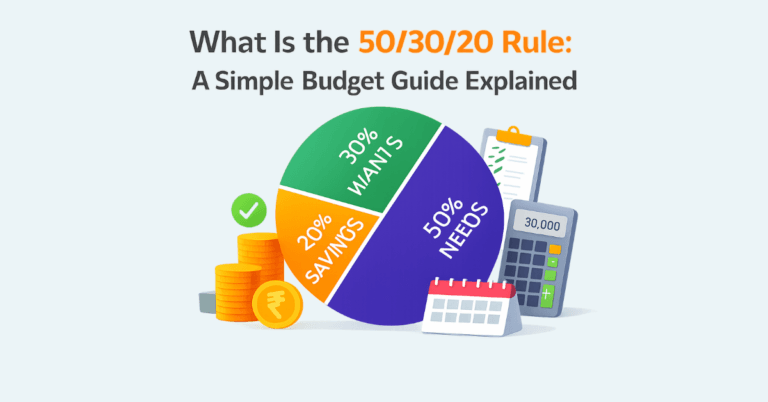

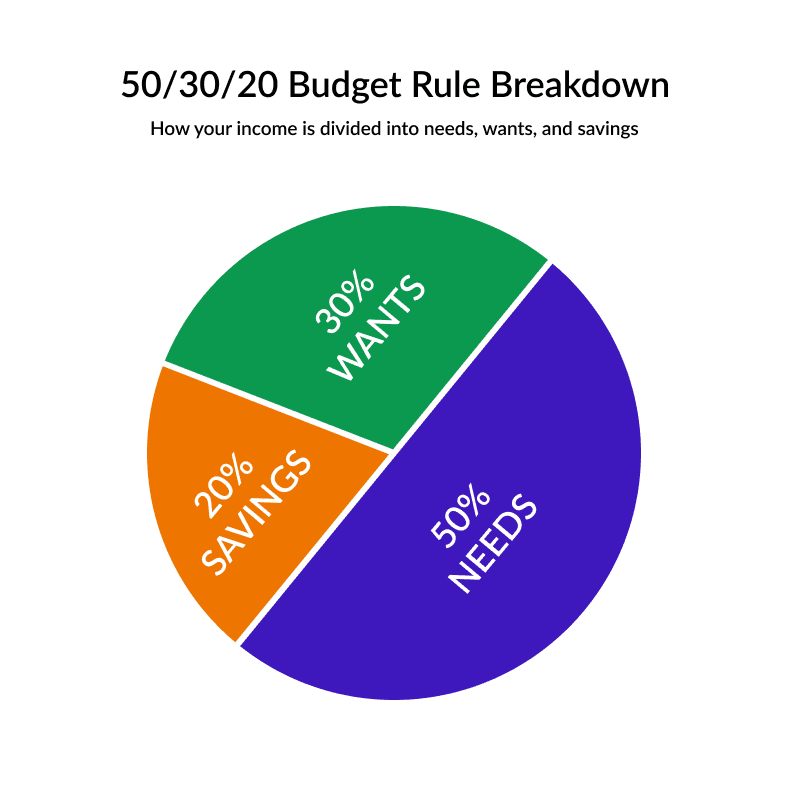

So, what is the 50/30/20 rule? It is a simple budgeting method that helps beginners divide income into needs, wants, and savings.

We’ll move slowly.

And if the rule doesn’t fit your life perfectly, that’s okay.

Table of Contents

ToggleIs the 50/30/20 Rule Perfect for You?

Before getting into numbers, let’s clear something important.

A budget is a tool, not a judgment.

If a tool doesn’t fit your life, you adjust it — not yourself.

Who Thrives With the 50/30/20 Rule

This rule usually works well if you:

- Are between 18–27 years old

- Earn a monthly salary or stable income

- Want clarity, not control

- Feel stressed by detailed expense tracking

- Tried budgeting before and felt overwhelmed

If you want a structure that feels light, this method can help.

When You’ll Need to Adjust It

You may need adjustments if:

- Rent or EMIs take up a large part of income

- Your income changes month to month

- You’re supporting family members

- You’re actively paying off debt

Needing changes does not mean the rule is wrong.

It just means we use it as a starting point, not a fixed rulebook.

What Is the 50/30/20 Rule and How Does It Work?

At its core, the 50/30/20 rule is a straightforward way to divide your monthly income. You may see variations like the 50-30-20 rule, 50-20-30 rule, 20/30/50 budget rule, or 30/20/50 rule. These names differ, but the concept remains the same.

The Core Formula That Changes Everything

You take your monthly take-home income and split it like this:

| Category | Share | Meaning |

|---|---|---|

| Needs | 50% | Essentials you must pay |

| Wants | 30% | Comfort and enjoyment |

| Savings | 20% | Future and safety |

That’s it.

No formulas.

No daily tracking.

Why the 50 30 20 Rule Works for Most Beginners

This approach works because it respects real life.

- It allows spending, so you don’t quit

- It creates clear limits, without stress

- It builds saving slowly, not forcefully

It’s less about discipline and more about balance.

50/30/20 Categories Explained: Real Examples You’ll Recognize

This is where most people get stuck, so we’ll keep it very clear.

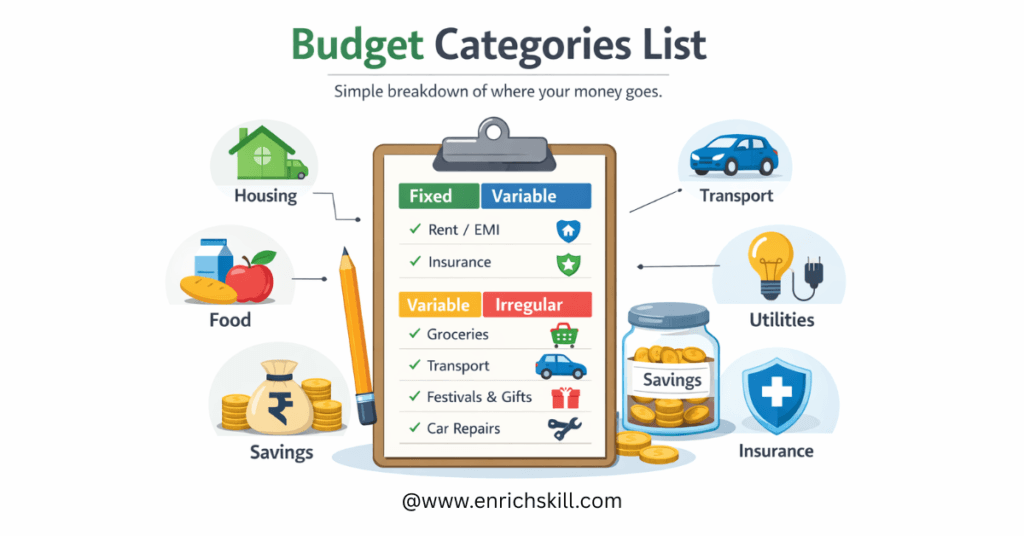

Needs (50%): The Must-Pays You Can’t Skip

Needs are expenses you can’t reasonably avoid.

Examples:

- Rent or home loan EMI

- Basic groceries

- Electricity, water, cooking gas

- Phone and internet (basic plans)

- Daily transport

- Health or term insurance

A simple check:

“If I stop paying this, will my daily life break?”

If yes, it’s probably a need.

Wants (30%): The Fun Stuff That Keeps You Sane

Wants are optional — and normal.

Examples:

- Eating out

- OTT subscriptions

- Shopping beyond basics

- Movies, trips, hobbies

- Gadget upgrades

A phone is a need.

Changing it every year is usually a want.

This rule expects you to have wants.

There’s no guilt here.

Savings (20%): Building Your Future Safety Net

Savings is money you don’t use today.

This can include:

- Emergency fund

- SIPs or long-term investments

- PPF / EPF / NPS

- Fixed deposits

- Extra loan payments

Savings isn’t about being perfect.

It’s about giving future-you fewer worries.

How to Use the 50/30/20 Rule: Step-by-Step

Let’s keep this practical.

Step 1: Figure Out Your Real Take-Home Pay

Use what actually reaches your bank account.

- Salary after tax

- Freelancers: average of last 3 months

A rough number is fine.

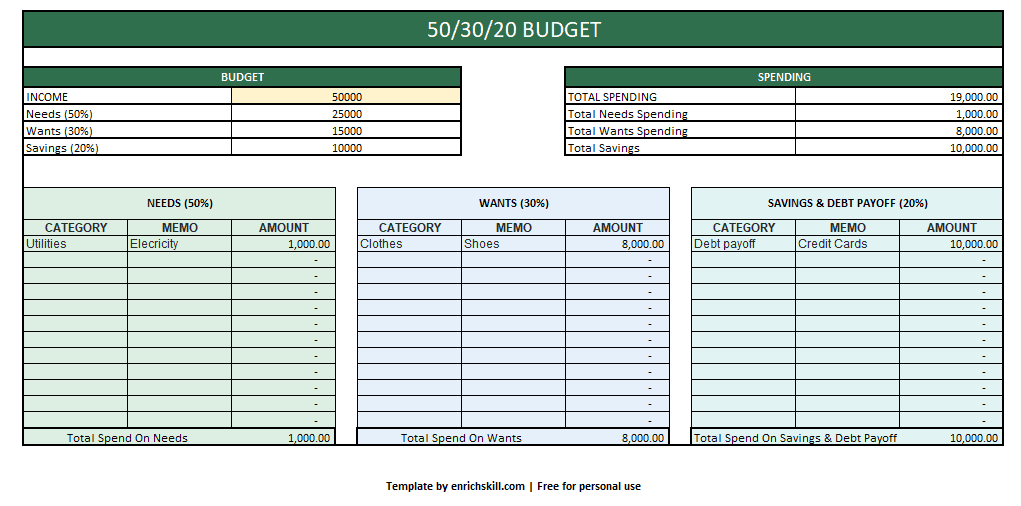

Step 2: Split It With the 50/30/20 Formula

Example:

Monthly income = ₹50,000

- Needs: ₹25,000

- Wants: ₹15,000

- Savings: ₹10,000

These are targets, not strict commands.

Step 3: Track Categories Only (Forget Daily Logging)

You don’t need to track every transaction.

At month-end, just ask:

- Did my needs stay around 50%?

- Did wants cross the limit?

- Did I save something?

This keeps budgeting calm.

Step 4: Adjust Ruthlessly — Perfection Isn’t the Goal

Some months won’t go as planned.

That doesn’t mean failure.

Notice patterns.

Adjust next month.

Budgeting is about direction, not perfection.

50/30/20 in Action: 3 Real-Life Budget Examples

Example 1: ₹40,000 Income in a Low-Cost City

| Category | Amount |

|---|---|

| Needs | ₹20,000 |

| Wants | ₹12,000 |

| Savings | ₹8,000 |

This often works when rent and transport are reasonable.

Example 2: ₹80,000 Income in a High-Cost Metro

If rent is high, the split may look like:

- Needs: 55%

- Wants: 25%

- Savings: 20%

The structure stays. The numbers adjust.

Example 3: Dual-Income Families Crushing It Together

Combine income first.

Then plan together.

This usually reduces confusion and stress.

When the 50/30/20 Rule Doesn’t Fit (And Smart Fixes)

Rent Eating 50%+ of Your Income? Here’s What to Do

This is common.

Options:

- Reduce wants temporarily

- Increase income over time

- Treat this as a phase, not permanent

Stability comes first.

Dealing With Debt and Big EMIs

EMIs usually count as needs.

If debt is high:

- Savings may drop for now

- That’s okay

- Clearing debt is progress

Freelancers: Surviving Irregular Income

A safer approach:

- Base expenses on a minimum income

- Save more in good months

Consistency matters more than exact ratios.

4 Deadly Mistakes That Kill the 50/30/20 Rule (Avoid These)

- Treating it as strict law

- Mixing wants into needs

- Quitting after one bad month

- Comparing with others

This method is meant to reduce stress, not create it.

Best Tools & Templates to Make 50/30/20 Effortless

Some people like tools. Some don’t.

Helpful options:

- A simple 50 30 20 rule spreadsheet

- Monthly check-in sheet

- Basic calculator

If tools help you stay calm, use them.

If they don’t, skip them.

Optional help is still help.

If you want to start immediately, you can use this simple 50/30/20 budget template to track needs, wants, and savings without stress.

Is the 50/30/20 Rule Right for You?

This rule may suit you if:

- You want clarity, not control

- You prefer simple categories

- You’re okay adjusting over time

If not, that’s fine.

Other methods exist, and we’ll explore them later.

The True Power of the 50/30/20 Rule: Long-Term Money Freedom

The goal isn’t perfect percentages.

The real goal is:

- Feeling calmer about money

- Knowing roughly where income goes

- Making small, repeatable improvements

This rule is a starting point, not a finish line.

If this guide made budgeting feel less scary, that’s progress.

If you’re curious instead of anxious, that’s a good sign.

And if the rule doesn’t work perfectly for you?

That’s okay.

We adjust — slowly, realistically, without pressure.

FAQ's

Q1. What is the 50/30/20 rule?

The 50/30/20 rule is a simple budgeting method that divides your monthly income into three parts: 50% for needs like rent and groceries, 30% for wants such as entertainment, and 20% for savings or investments. It helps beginners manage money without complex tracking.

Q2. Is the 50/30/20 rule good for beginners?

Yes, the 50/30/20 rule is ideal for beginners because it focuses on broad spending categories instead of detailed expense tracking. It reduces stress, allows flexibility, and makes saving money feel more manageable for people new to budgeting.

Q3. Can I change the 50/30/20 rule percentages?

Yes, the percentages can be adjusted based on your situation. If rent or EMIs are high, you may increase the needs portion and reduce wants temporarily. The rule is meant to be flexible and used as a guideline, not a strict formula.

Q4. Does the 50/30/20 rule work in India?

The 50/30/20 rule can work in India, especially for salaried individuals and beginners. However, high rent, family responsibilities, or variable income may require small adjustments while keeping the same basic structure.

Q5. What if my rent is more than 50% of my income?

If rent alone exceeds 50% of your income, focus on reducing discretionary spending and treat the situation as temporary. The priority should be financial stability first, while gradually improving income or adjusting expenses over time.

ABOUT THE AUTHOR

MD JALEEL

Jaleel is the founder of EnrichSkill, an India-based finance and self-growth blog focused on simplifying money concepts for beginners. He is a self-taught finance learner, gaining knowledge through online courses, continuous research, and practical understanding of personal finance topics.

Disclaimer: Not a Certified Financial Advisor. Content is for educational purposes only.