You know you should budget.

You’ve probably tried once or twice.

Maybe you opened a spreadsheet, stared at it for ten minutes, then closed it.

Or downloaded an app that asked you to categorize 47 different things before you even started.

Here’s what nobody tells you: the hard part isn’t tracking money.

It’s knowing where to put it.

This budget categories list gives you every category you might need—the boxes where your money actually goes. Not theory. Not motivation. Just the categories you need, with examples that make sense.

What this page will help you do:

- See every possible category in one place

- Pick the ones that match your actual life

- Set up a working budget in under 30 minutes

- Stop wondering if you’re “doing it wrong”

Table of Contents

ToggleWhat Are Budget Categories?

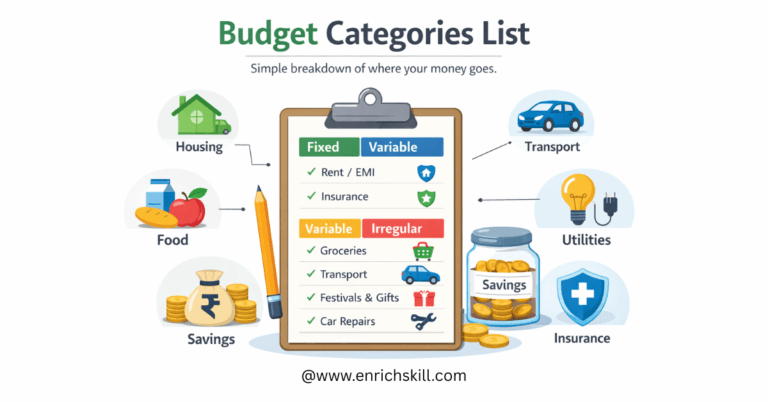

Budgeting categories are labeled boxes for your money.

Think of them like folders on your phone.

Instead of 200 random photos, you have folders: Family, Friends, Travel, Memes.

Same idea.

Instead of “I spent ₹45,000 this month” (which tells you nothing), you see:

- ₹15,000 → Rent

- ₹8,000 → Food

- ₹5,000 → Transport

- ₹17,000 → Everything else

Now you know where your money went.

That’s it. That’s a budget category.

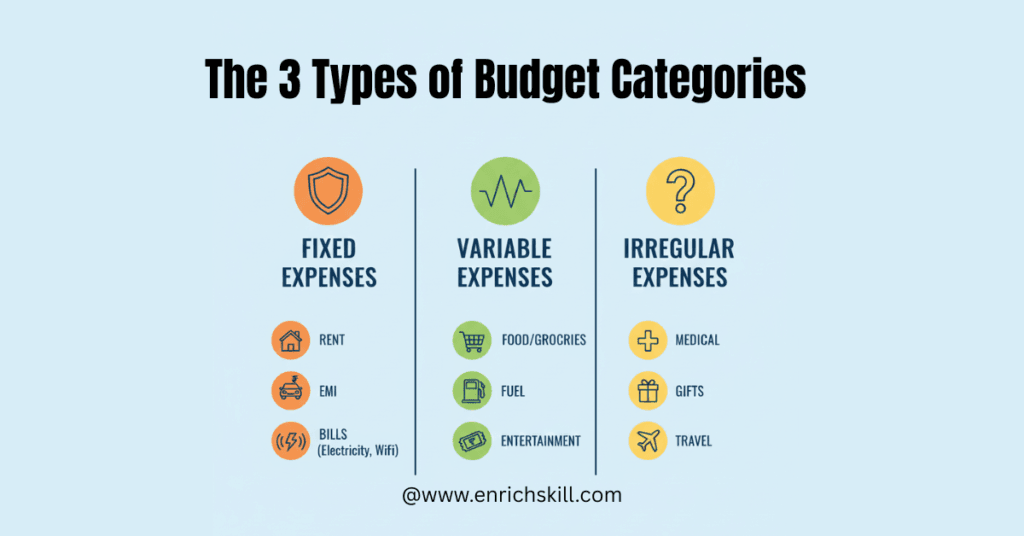

The 3 Types of Budget Categories You Need to Know

The 50/30/20 Rule: Budgeting Made Simple

Stop overcomplicating your finances. Learn the golden rule that divides your paycheck perfectly—math skills not required.

Every expense you have fits into one of three types.

Understanding this makes everything clearer.

Fixed Expenses

Same amount. Every month. No surprises.

Examples: Rent, car EMI, Netflix subscription, gym membership.

These are easy to budget because the number doesn’t change.

You know exactly what’s coming.

Variable Expenses

You need them every month, but the amount changes.

Examples: Groceries, electricity bill, fuel, eating out.

These need attention.

If you’re not tracking them, they quietly eat your budget.

Irregular/Periodic Expenses

They don’t happen monthly. But they will happen.

Examples: Car insurance (yearly), laptop repair, Diwali gifts, cousin’s wedding.

Common mistake: Most people forget these. Then panic when ₹12,000 suddenly disappears in October.

If you budget for them monthly (even ₹1,000/month), they stop being emergencies.

Complete Budget Categories List

Here’s the full list of categories.

You won’t use all of them and that’s fine.

Scan through. Mark the ones that apply to your life right now.

Essential Fixed Expense Categories

| Category | Items Included |

|---|---|

🏠 Housing |

|

⚡ Transportation |

|

🛡️ Insurance & Protection |

|

💳 Debt Payments |

|

🎓 Childcare & Education |

|

Variable Expense Categories

| Category | Items Included |

|---|---|

🍲 Food |

|

💡 Utilities |

|

🚗 Transportation (Variable) |

|

🩺 Healthcare |

|

🧴 Personal Care |

|

🐾 Pet Care (if applicable) |

|

Savings & Investment Categories

| Category | Items Included |

|---|---|

🚨 Emergency Fund |

|

🧓 Retirement Savings |

|

🎯 Short-Term Savings Goals |

|

📈 Investments |

|

Irregular Expence Vategories

| Category | Items Included |

|---|---|

📅 Irregular Expense Categories |

|

Real-life example: ₹6,000 Amazon Prime annually = ₹500/month budget. Save that much monthly instead of getting surprised once a year.

Modern Categories You Might Need

Life changed. Your budget should too.

| Category | Items Included |

|---|---|

📺 Digital Subscriptions |

|

💻 Work-From-Home Expenses |

|

🛠️ Side Hustle Costs |

|

🛒 Online Shopping |

|

How Much Should You Spend Per Category?

This is where people get stuck.

“Okay, I have categories… now what?”

Here’s a starting point. Not a rule. A guide.

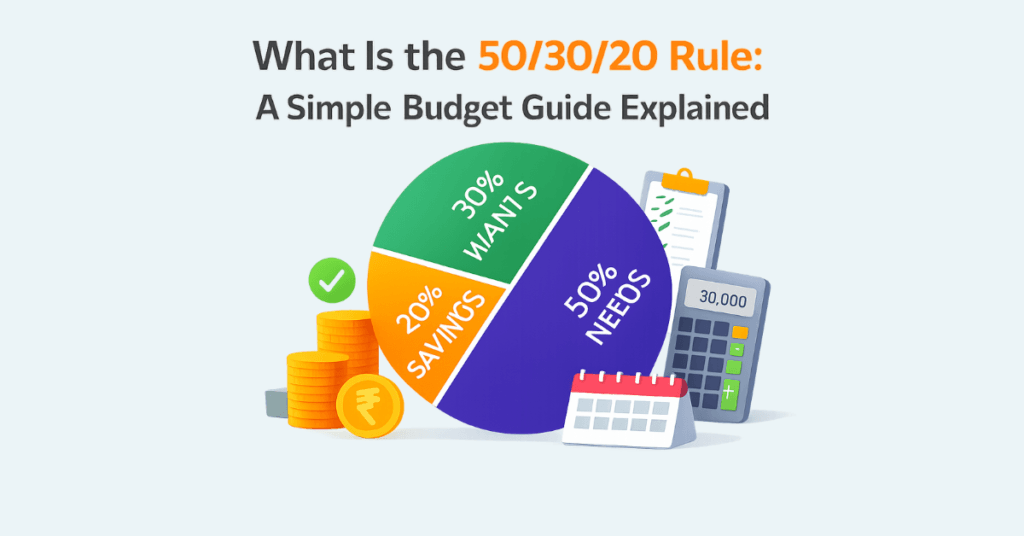

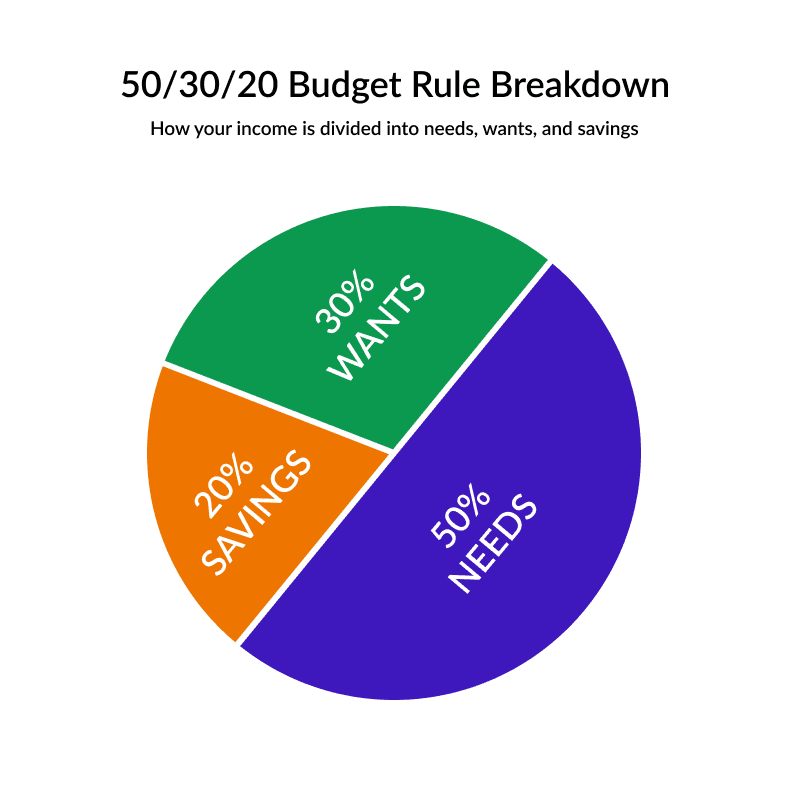

The 50/30/20 Budget Rule

This is the simplest framework for beginners.

Learn more about the 50/30/20 rule here

| Category | Percentage | What It Includes |

|---|---|---|

🏠 Needs | 50% | Rent, utilities, groceries, transport, insurance, loan EMIs |

🎮 Wants | 30% | Eating out, entertainment, shopping, hobbies |

💰 Savings | 20% | Emergency fund, investments, extra loan payments |

Real-life example on ₹40,000/month income:

- ₹20,000 on needs

- ₹12,000 on wants

- ₹8,000 on savings

Does this work for everyone? No.

If you live in a high-rent city, needs might be 60-65%. That’s reality. Adjust.

Alternative Percentage Guidelines

If the 50/30/20 doesn’t fit, here are rough targets:

| Category | Percentage Range |

|---|---|

🏠 Housing | 25–35% |

🍲 Food | 10–15% |

🚗 Transportation | 10–15% |

💰 Savings | Minimum 10%, aim for 20% |

🛡️ Insurance | 3–5% |

These are averages. Your life might look different. This is normal.

Important: If your needs exceed 60% of income, you have two options:

- Increase income (side work, ask for raise)

- Decrease needs (cheaper rent, roommate, less transport)

Not judgment. Just math.

How to Choose the Right Categories for You

Don’t copy someone else’s budget.

Build one that matches your actual life.

Start Simple

Begin with 10-12 main categories. Seriously.

Minimum viable budget for beginners:

- Housing

- Food

- Transport

- Utilities

- Insurance

- Debt payments

- Savings

- Shopping/personal

- Entertainment

- Miscellaneous

Track these for one month. See what happens.

Add more detail only if you need it.

Common Mistakes to Avoid

Mistake 1: Too many categories

- 30+ categories = decision fatigue

- You’ll stop tracking by week 2

Mistake 2: Too few categories

- “Miscellaneous” shouldn’t be 40% of your budget

- That means you’re not actually tracking

Mistake 3: Treating “Eating Out” and “Groceries” the same

- These behave differently

- One is predictable. One sneaks up on you.

Mistake 4: No category for irregular expenses

- If you don’t budget for car repairs, your “savings” becomes your repair fund

- That’s not savings. That’s panic money.

When to Split or Combine Categories

Split a category when:

- It’s more than 10% of your budget and you keep overspending

- Example: If “Food” is always over budget, split into “Groceries” and “Eating Out”

Combine categories when:

- You’re tracking two things that barely get used

- Example: “Gym” and “Sports” can just be “Fitness” if you spend ₹500 total

Test this: If you can’t remember which category something goes in, your system is too complicated.

4 Steps to Set Up Your Budget Categories

You don’t need a perfect system.

You need one that works.

Step 1: Track Your Current Spending

Open your bank app. Look at the last 2-3 months.

Write down where money actually went. Not where you wish it went—where it did go.

Step 2: Choose Your Categories

From the budget categories list above, pick 10-15 that match your spending patterns.

If you don’t have a car, skip transport categories.

If you have pets, add pet care.

Make it yours.

Step 3: Assign Dollar Amounts

Use your actual spending from Step 1 as a starting point.

If you spent ₹6,000 on food last month, start with ₹6,000.

Add 10-15% buffer for variable categories (groceries, utilities).

Step 4: Test and Adjust

Track for one month. See what was too high, too low, or missing.

Fix it. Repeat next month.

By month 3, your budgeting categories will feel natural.

This is normal: Month 1 will be messy. That’s not failure. That’s data collection.

Free Budget Categories Template

We’ve created a simple checklist template you can download.

What’s included:

- All categories from this list

- Checkbox to mark which ones you’ll use

- Space to write your monthly budget amount

- Notes section for irregular expenses

How to use it:

- Print or open in Google Sheets

- Check off your categories

- Fill in amounts from your bank statements

- Adjust as you go

No formulas. No macros. Just a clean list you can customize.

Final Thoughts

You don’t need a perfect budget.

You need one that’s better than nothing.

Start with 10 categories. Track for a month. Adjust what doesn’t work.

If you miss a week of tracking, don’t restart. Just pick up where you left off.

Most people fail at budgeting because they aim for perfection.

You’re aiming for “good enough to see where my money goes.”

That’s already more than most people do.

The budget categories list is here. The template is ready.

Now just start. Messy is fine. Messy still works.

ABOUT THE AUTHOR

MD JALEEL

Jaleel is the founder of EnrichSkill, an India-based finance and self-growth blog focused on simplifying money concepts for beginners. He is a self-taught finance learner, gaining knowledge through online courses, continuous research, and practical understanding of personal finance topics.

Disclaimer: Not a Certified Financial Advisor. Content is for educational purposes only.